VTEX Reports Third Quarter 2021 Financial Results

VTEX delivered strong Q3 results, reflecting robust growth and consistent execution November 17, 2021

NEW YORK, November 17, 2021 – VTEX (NYSE: VTEX), the enterprise digital commerce platform for premier brands and retailers, the leader in accelerating the digital commerce transformation in Latin America and now expanding globally, today announced results for the third quarter of 2021 ended September 30, 2021. VTEX results have been prepared in accordance with International Accounting Standard 34, “Interim Financial Reporting”.

Geraldo Thomaz, founder and co-CEO of VTEX, commented, “We are pleased to announce that VTEX delivered another quarter of robust growth and consistent execution. We are excited to see VTEX’s recent product launches and new partnerships, as well as strong sales momentum and encouraging backlog of new online stores undergoing implementation to join our platform.” Mariano Gomide de Faria, founder and co-CEO of VTEX, added, “Consumer behaviour shift towards online purchasing had staying power. This is just the tip of the iceberg, ecommerce in Latin America is still an untapped opportunity. We are living in a new era, a revolution, and we are here to accelerate it.”

Third Quarter 2021 Operational and Financial Highlights

- GMV reached US$2.3 billion in the third quarter of 2021, representing a year-over-year increase of 7.2% in USD and 4.2% on an FX neutral basis.

- Total revenues increased to US$31.9 million in the third quarter of 2021, from US$27.7 million in the third quarter of 2020, representing a year-over-year increase of 15.2% in USD and 12.3% on an FX neutral basis.

- Subscription revenue represented 93.0% of total revenues and increased to US$29.6 million in the third quarter of 2021, from US$26.3 million in the third quarter of 2020, a year-over-year increase of 12.6% in USD and 9.7% on an FX neutral basis.

- Non-GAAP subscription gross profit was US$20.2 million in the third quarter of 2021, compared to US$20.4 million in the second quarter of 2021.

- Non-GAAP subscription gross margin was 68.2% in the third quarter of 2021, compared to 68.8% in the second quarter of 2021. Non-GAAP subscription gross profit margin quarter-over-quarter compression reflects incremental investments in cybersecurity, privacy and compliance mostly related to our global expansion and becoming a public company.

- Non-GAAP loss from operations was US$13.3 million during the third quarter of 2021, compared to Non-GAAP income from operations of US$6.3 million in the third quarter of 2020, primarily due to incremental personnel-related investments in sales and marketing and research and development, as we have been investing to capture market share and benefit from the further penetration of ecommerce.

- Non-GAAP negative free cash flow was US$10.4 million during the third quarter of 2021, compared to a positive US$11.6 million free cash flow in the third quarter of 2020, mainly driven by the increase in Non-GAAP loss from operations.

- Our total headcount increased to 1,624 as of September 30, 2021, representing an increase year-over-year of 91.7%.

Third Quarter Product Innovation Highlights:

We innovate aligned with our guiding principles. VTEX key innovations deployed this quarter were:

- Zero friction onboarding:

- VTEX launched self-service onboarding for the seller’s portal, reducing our customers’ time to revenue.

- Zero friction collaboration:

- We built the new seller’s portal that enables partners of our customers, franchisers or SMB’s to more easily sell into their marketplaces, making collaboration between the online store, the franchiser or the brick-and-mortar stores seamless.

- We certified our integration with Mercado Libre in Brazil, a significant milestone in our journey to become the center of a vast network that natively connects every part of the global digital commerce ecosystem.

- We enhanced our OMS’s order progress flow system, reducing refresh time to seconds without external event dependencies, such as manual authorization, cancellation windows and anti-fraud. This fits grocery, food & beverage and pet shop companies’ needs, among others, as it enables them to have faster communication between channels, avoid out of stock scenarios and deliver faster to their consumer’s doorstep.

- Single control panel for every order:

- We enhanced our in-store solution with an endless aisle approach that enables brick-and-mortar stores to sell products from other brick-and-mortar stores as well as from the ecommerce store. We’ve improved messaging between the different sales channels, tuned search filters and added social selling.

- We launched a new dashboard that tracks additional key performance indicators of our customers, such as their cart-to-checkout and payment conversion rates.

- The development platform of choice for digital commerce:

- AWS partnership will enable us in the long-term to expand our presence in the global digital commerce segment by using AWS technologies and leveraging AWS’ sales channels to build innovative, customer-centric capabilities for consumer packaged goods companies.

- The new global integration with Facebook aims to ensure better conversion rates in ecommerce by leveraging online campaigns with data intelligence and improving sales conversion natively on the platform.

- Subsequent to the third quarter 2021, we launched a partnership with Stripe to help brands and retailers to offer the most popular payment methods to their consumers regardless of their operating areas.

- The strategic partnership with McFadyen in Brazil and in the US will allow us to leverage not only their technical and architectural expertise, but also the depth and breadth of business planning their strategy practice can offer.

Business Outlook

Online commerce penetration in Latin America continues to increase, demonstrating that the 2020 acceleration in online consumption appears sustainable, even as brick-and-mortar retail stores gradually reopen throughout the region and we lap our toughest comps quarter. Consumer behaviour shift towards online purchasing has demonstrated staying power.

Our Q3 2021 FX Neutral year-over-year revenue growth of 12.3% already accelerated to over 20% by the end of the quarter, and it came on top of 140% year-over-year growth in Q3 2020. We expect our revenue growth to continue accelerating during the Q4 of 2021, as in Q4 2020 brick-and-mortar stores were already starting to reopen.

Seasonal trends in 2021 are expected to remain similar as in previous years. We expect to continue seeing strong new stores’ growth, as our encouraging backlog undergoes implementation. While supply chain challenges may impact commerce during Q4 2021, we are focused on supporting our customers on a successful Black Friday, Cyber Monday and the holiday shopping season.

In view of the aforementioned trends and VTEX’s performance during the nine months ending September 30, 2021, we currently expect to deliver growth at healthy levels. We are targeting revenue in the US$35.3 million to US$37.3 million range for the fourth quarter of 2021, implying a 27% YoY FXN growth rate in the middle of the range. Although Latam currencies devalued 6.7% during Q3 2021, we are confirming our target of US$124 million to US$126 million range for the fiscal year ended December 31, 2021, assuming current period FX rates.

Importantly, we will continue to invest to grow our business as we work towards continuing to enhance our leadership position in Latin America and explore new opportunities outside the region.

The business outlook provided above constitutes forward-looking information within the meaning of applicable securities laws and is based on a number of assumptions and subject to a number of risks. Actual results could vary materially as a result of numerous factors, including certain risk factors, many of which are beyond VTEX’s control. See the cautionary note regarding ”Forward-Looking Statements” below. Fluctuations in VTEX’s operating results may be particularly pronounced in the current economic environment. There can not be assurance that VTEX will achieve these results.

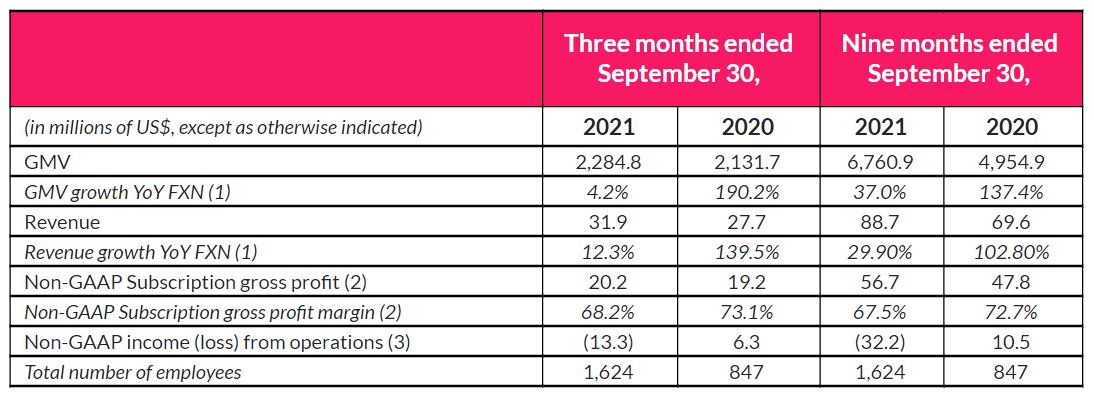

The following table summarizes certain key financial and operating metrics for the three and nine months ended September 30, 2021 and 2020.

(1) Calculated by using the average monthly exchange rates for the applicable months during 2020, adjusted by inflation in countries with hyperinflation, and applying them to the corresponding months in 2021, as applicable, so as to calculate what our results would have been had exchange rates remained stable from one year to the next.

(2) Corresponds to our subscription revenues minus our subscription costs.

(3) Reconciliation of non-GAAP income (loss) from operations to income (loss) from operations can be found in tables below.

About VTEX

VTEX (NYSE: VTEX) provides a software-as-a-service digital commerce platform for enterprise brands and retailers. Our platform enables our customers to execute their commerce strategy, including building online stores, integrating and managing orders across channels, and creating marketplaces to sell products from third-party vendors. Founded in Brazil, we have been a leader in accelerating the digital commerce transformation in Latin America and are expanding globally. Our platform is engineered to enterprise-level standards and features. We are trusted by more than 2,000 customers with over 2,500 active online stores across 32 countries, who rely on VTEX to connect with their consumers in a meaningful way*.

*Figures as of FY ended on Dec. 31st, 2020

Press Contacts

Walker Sands

vtex@walkersands.com

312-267-0064